You may have heard about the 2023 Inflation Reduction Act (IRA), which provides significant investment in the form of tax credits and rebates for Jacksonville homeowners who upgrade their homes to make them more energy efficient. Some of these upgrades can also lower your energy bill in the long run, so it’s an investment worth looking into.

IRA tax credits and rebates: how much can I save?

Homeowners in the Jacksonville area can save a whopping $17,000 in tax credits and rebates through the IRA by making energy efficient HVAC upgrades. This handy savings calculator on Rewiring America’s website can help you estimate how much money you might save on your utility bills. Talk with the HVAC professionals at Snyder Air Conditioning, Plumbing & Electric to see what home updates might be right for you. Give us a call at 904-441-5434.

Inflation Reduction Act tax credits

To start with, certain tax credits are available for Jacksonville homeowners who purchase and install energy-saving upgrades to their homes, such as energy-efficient doors and windows, air conditioners, furnaces, and more.

25C tax credit for energy-efficient home improvements

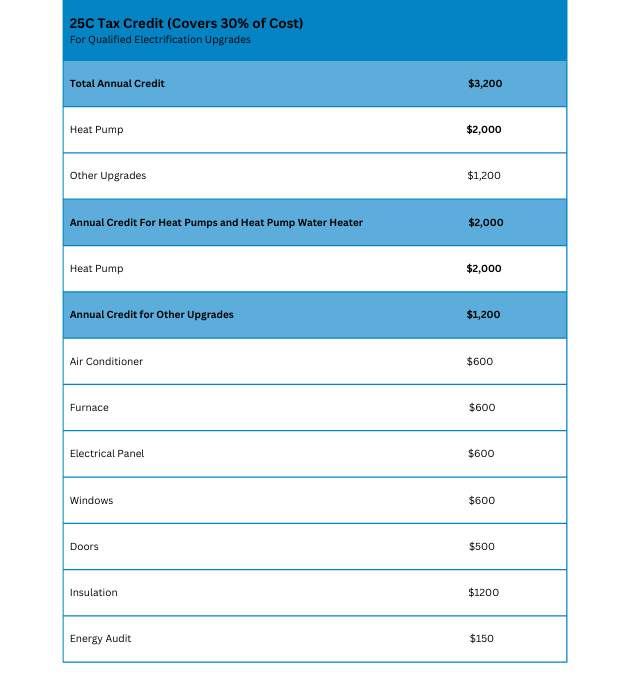

The Energy Efficient Home Improvement Tax Credit included in the Inflation Reduction Act is an expansion of the 25C tax credit, and it allows homeowners to deduct up to 30% of the cost of certain energy-efficient home improvements, up to $3,200 per year. Check out the list below to see what appliances and upgrades are eligible for this tax credit.

Keep in mind that any new appliances or home upgrades you make need to meet certain requirements in order to qualify for the 25C tax credit.

Find a list of Energy Efficient Home Improvement Tax Credit and eligible appliances here.

The AC professionals at Snyder are standing by when you decide to invest in energy-efficient home upgrades or replacements. Give us a call at 904-441-5434.

IMPORTANT NOTE: These tax credits will be added to your tax credit amount when you file next year; they are not up-front savings on the purchase of new equipment or appliances. And while Snyder is happy to provide information on qualifying appliances, we cannot provide any tax or other financial advice. Please contact your tax professional if you need help filing when the time comes.

Eligibility for the IRA 25C tax credit

All homeowners are eligible for the Energy Efficient Home Improvement Tax Credit. The credit resets each year, which means that it will apply to any qualifying equipment you install or upgrades you make in 2023 and beyond.

Annual caps

Annual caps for these tax credits are $1200 per household per year, or $2000 for upgrade that include heat pumps, with a total annual cap of $3200. If you’ve been considering making any home improvements like these, now is a great time to take advantage of these tax savings! Call Snyder Air Conditioning, Plumbing & Electric at 904-441-5434 for advice on products or installation.

Claiming your Inflation Reduction Act tax credits

Snyder Air Conditioning, Plumbing & Electric can provide you with the necessary documentation regarding your new qualified energy efficient upgrades so you can claim your tax credits when you file next year. However, we cannot offer tax or financial advice. Please consult with your accountant or tax professional when the time comes.

Inflation Reduction Act home improvement rebates

Jacksonville-area homeowners can also benefit from rebates that are included in the IRA.

HEEHRA (High Efficiency Electric Home Rebate Act)

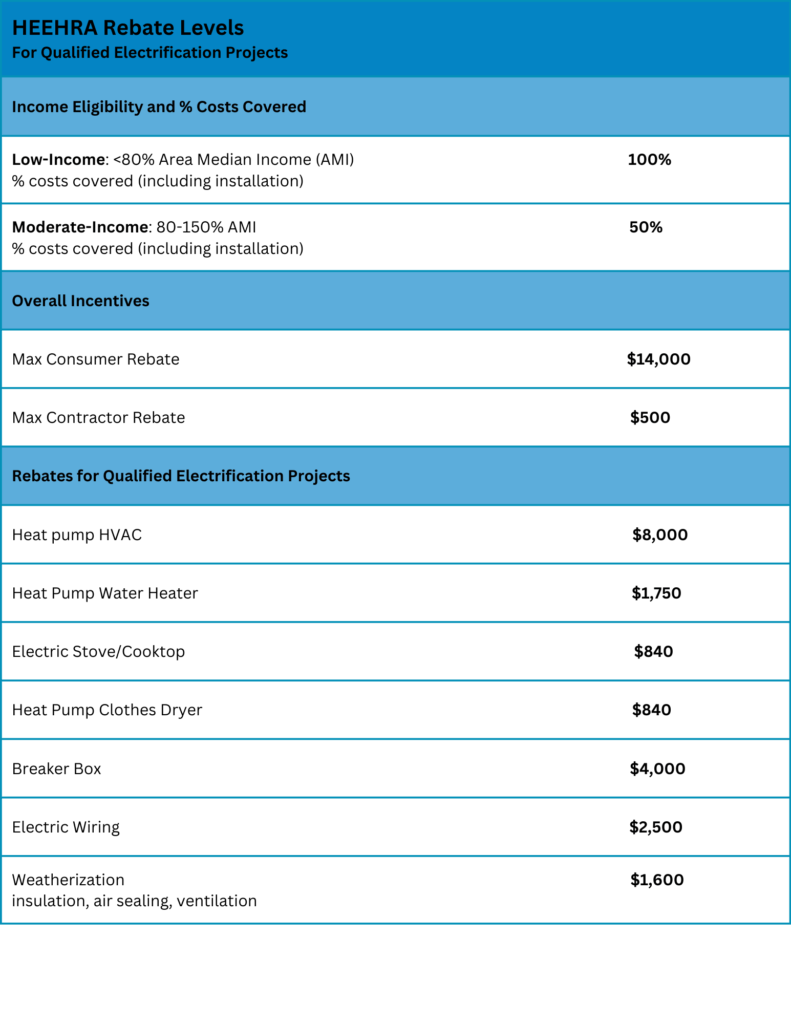

The High Efficiency Electric Home Rebate Act (HEEHRA) can save up to $14,000 per year for low- to moderate-income households that make energy-efficient appliance upgrades. Check the chart below for all the info you need about the HEEHRA rebate program.

Rebates are applied to the purchase of the appliance under the HEEHRA program—they are not tax credits.

Home Owners Managing Energy Savings (HOMES) Rebate

The other rebate program included in the IRA is the HOMES rebate, which encourages energy savings by reimbursing homeowners for whole-house energy improvements. That means that when you make HVAC or electrical upgrades that reduce your energy consumption, you will earn more money back.

With the HOMES program, the more energy you save, the bigger the rebate. Households that reduce energy use by 20%-35% can save $2000 to $8000!

HOMES rebates are available to all households, but the rebate amount is doubled for low- and moderate-income households. In addition, up to 80% of project costs will be covered by the program.

Most of the rebates offered under the Inflation Reduction Act will be available by the end of 2023, depending on DOE regulations and Florida state guidelines. To see if rebates are available when you’re ready to purchase, contact Snyder at 904-441-5434.

Save money on energy-efficient home upgrades this year!

The Inflation Reduction Act was crafted to help control the costs associated with the overuse of fossil fuels, as well as to reduce pollution and promote cleaner energy solutions throughout the United States. Homeowners can ease their energy spending, reduce their tax liability, and receive a financial return when purchasing energy-efficient appliances and other home upgrades.

At Snyder Air Conditioning, Plumbing & Electric we are happy to answer all your questions regarding potential home improvements or the Inflation Reduction Act; just give us a call at 904-441-5434.

(A REMINDER: We are not tax professionals and can’t offer financial advice. Please contact your tax preparation professional or the IRS website for help in filing your taxes and claiming any credits.)

Frequently Asked Questions

What are the differences between tax credits and rebates under the Inflation Reduction Act?

If you upgrade your home, you can claim the tax credits included in your IRA on your tax return, which reduces your tax liability. With the 25C tax credit, customers can receive an annual tax incentive of up to $3200 with the IRA. The tax credit can be claimed for both this year and next year if you install a heat pump air conditioning system or a heat pump water heater in your home.

A rebate is a type of upfront savings that is applied at the point of sale. The service provider is responsible for handling the paperwork and processing the rebate.

Can rebates be applied retroactively?

Rebates will be retroactive at the discretion of each state, according to state energy offices.

Is it possible to combine rebates and tax credits?

HOMES and HEERHA rebates cannot be used for the same upgrade, but they can be combined for separate upgrades.

Inflation Reduction Act tax credits can still be claimed while getting HEEHRA and HOMES rebates.

What should I do first?

Whether you need electrical upgrades, energy efficient plumbing, or any other type of inflation reduction act incentive, Snyder’s trusted experts in the Jacksonville, FL area know all the ins and outs of the Inflation Reduction Act incentives and can provide you with all the information you need to apply for the tax credits or rebates you qualify for. Call us today at 904-441-5434 to schedule an appointment or ask any questions.